How MetaLearner Is Redefining Dynamic Pricing

Some business decisions have always felt more like art than science. Setting the right price for a product is one of them. For years, sales, finance, and planning teams have balanced intuition, commercial pressure, inventory levels, market trends, and a history of data that rarely speaks the same language. At MetaLearner, we decided it was time to simplify that puzzle.

A Module That Combines Intelligence, Not Just Data

The Dynamic Pricing module was born from integrating several of MetaLearner’s most powerful agents. It is not simply an algorithm that suggests prices. It is a system that understands the full context of your business before making any recommendation.

A key capability is that the entire process runs automatically. MetaLearner’s Database Agent connects directly to the customer’s database, which ensures that all relevant information, including sales history, inventory levels, costs, and product attributes, flows into the system without manual uploads, spreadsheets, or cleanup work. The platform always works with the most current data in real time.

Building on this foundation, the Forecast Agent projects demand by detecting seasonality, peaks, downtrends, and cyclical patterns. At the same time, the External Data Agent incorporates outside signals, such as commodity price fluctuations, macroeconomic indicators, and cost shocks. This enables MetaLearner to anticipate market behavior rather than simply react to it.

Together, these agents transform a traditionally reactive pricing approach into a proactive, predictive, and fully automated strategy.

The User Journey: Clarity, Transparency, and Total Control

Before recommending any price, MetaLearner guides the user through an analytical flow designed to provide absolute transparency and understanding. Transparency is a core principle of the module: users must always know what is happening with their products, how demand behaves, and why MetaLearner is suggesting a specific price.

MetaLearner gives users full visibility into the data, the patterns, and the decision-making behind every recommendation. The system does not hide anything. It surfaces the evidence: how the product performs at different price ranges, how sensitive demand is to price changes, and how internal and external pressures shape pricing decisions.

It’s not a black box. It’s a tool that enhances your judgment by giving you the full story behind every number.

1. Historical Price Range Analysis

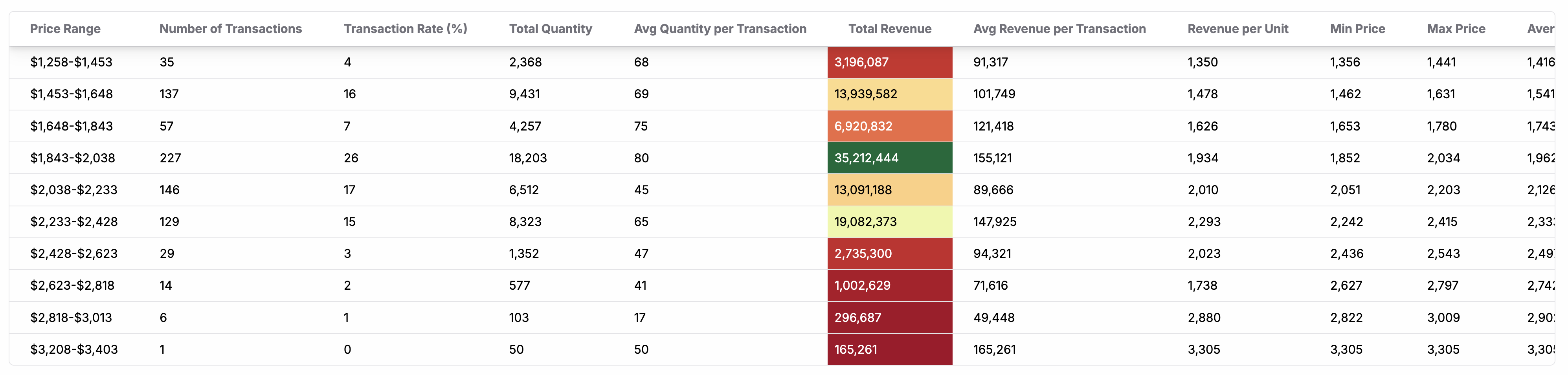

Raw sales data contains thousands of unique price points, and analyzing each individual price often leads to statistically insignificant insights that hide meaningful patterns. To make analysis more effective, MetaLearner introduces adaptive price binning. Users can either define the number of equal-range bins or create fully customized bin ranges.

Metrics Calculated for Each Bin

- Volume metrics: Total quantity and average quantity per transaction

- Transaction metrics: Transaction count and transaction rate (percentage of all transactions)

- Revenue metrics: Total revenue, average revenue per transaction, and revenue per unit

- Price statistics: Minimum, maximum, average, and standard deviation within the bin

With these metrics, users can see which price ranges have historically driven the most revenue, transactions, and volume. This helps reveal natural demand clusters and zones of price sensitivity.

2. Elasticity Analysis

Elasticity shows how sensitive demand is to changes in price. It is calculated as:

Elasticity = (% Change in Quantity Demanded) / (% Change in Price)

The elasticity value helps interpret customer behavior:

- Elastic (|E| > 1): Demand is highly sensitive to price changes

- Inelastic (|E| < 1): Demand is relatively insensitive

- Negative values: Typical for normal goods, where higher prices reduce demand

- Positive values: Found in Veblen goods, Giffen goods, or other anomalies

By calculating elasticity for each price transition, MetaLearner highlights where in the price spectrum the product is most or least sensitive. For example:

- $2331 to $2526 bin: elasticity = -6

- $2526 to $2720 bin: elasticity = -14

- $2915 to $3305 bin: elasticity = -4

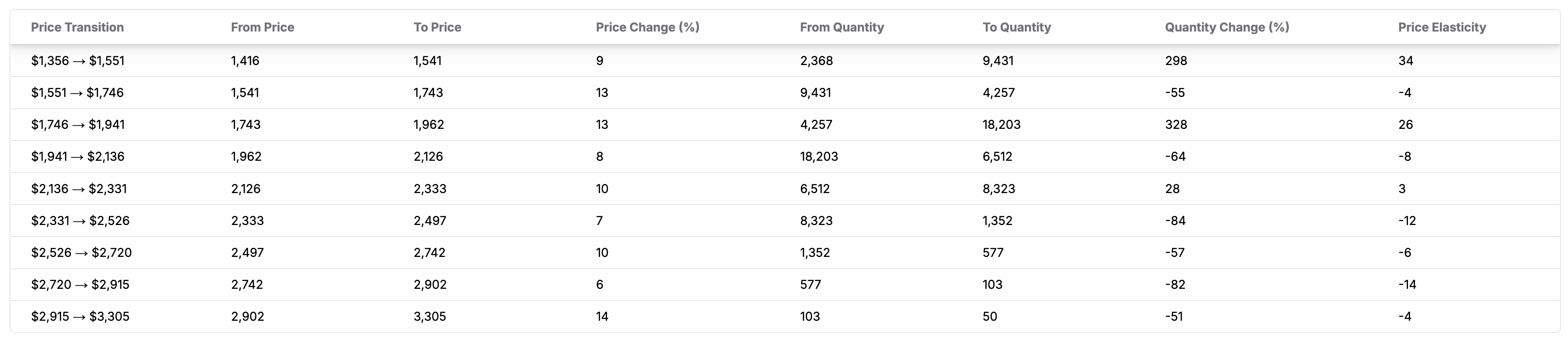

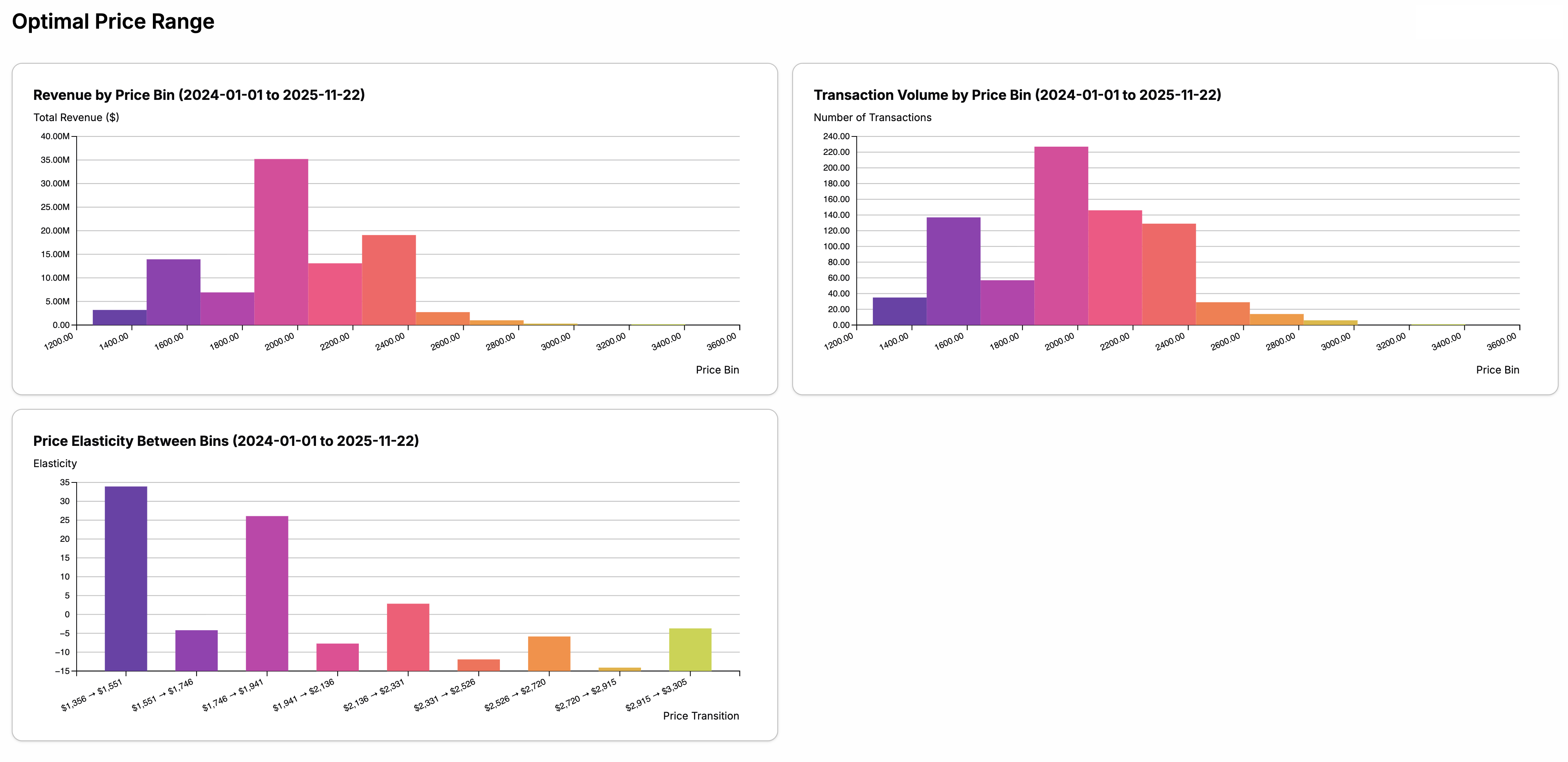

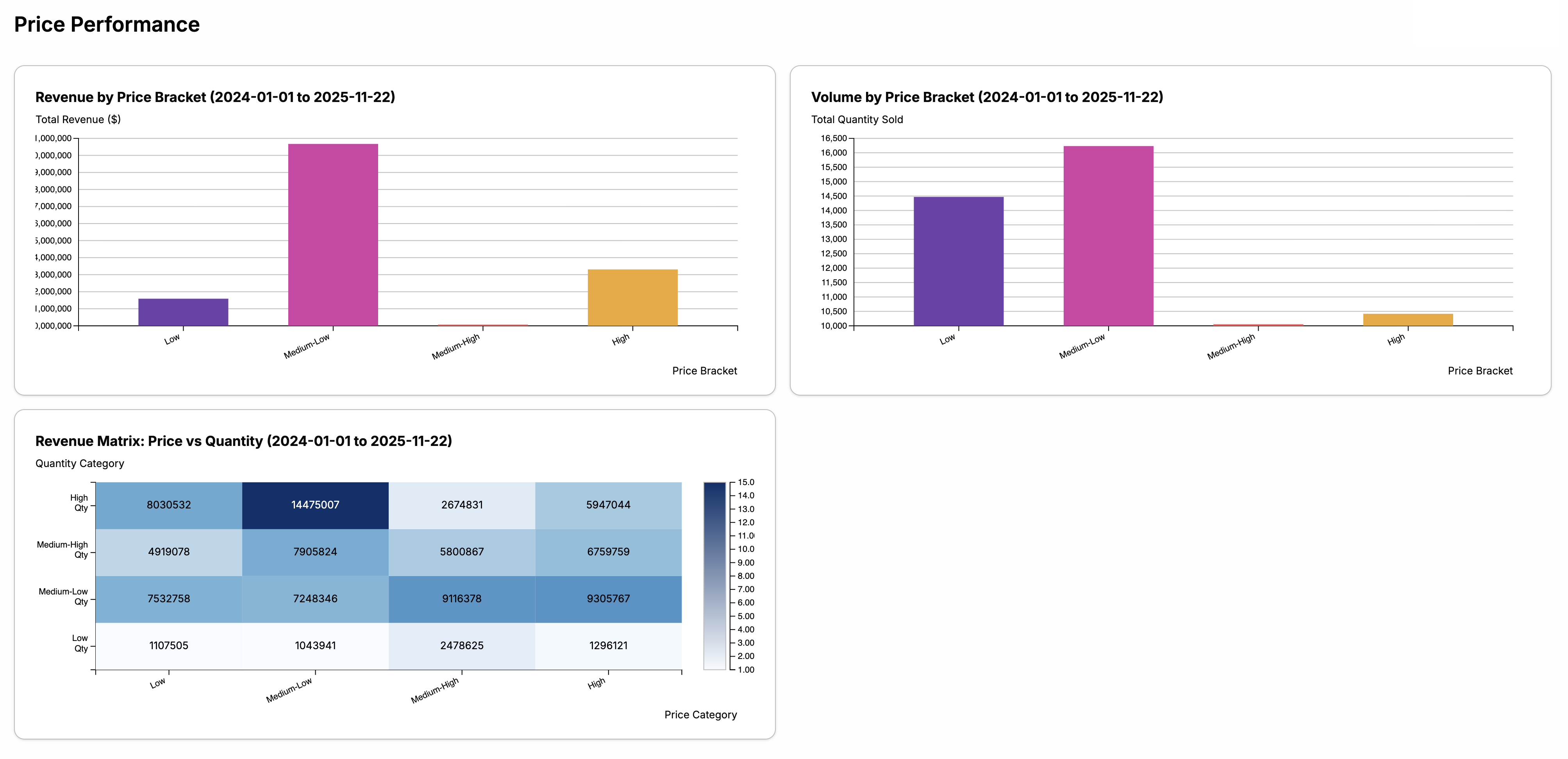

3. Optimal Price Range Identification

MetaLearner identifies the price bin that has historically maximized revenue while taking into account total revenue, transaction volume, average quantity per transaction, and pricing stability.

Users gain more than just an optimal price point. They also see the reasoning behind it, including revenue distribution that highlights the peak, elasticity that explains sensitivity around that point, transaction frequency that ensures sufficient data support, and performance metrics that clarify the price-quantity relationship.

The Five Pillars of Choosing the Right Price

At the heart of MetaLearner’s Dynamic Pricing Tool are five analytical pillars. Each one is powered by a specialized MetaLearner agent designed to handle a specific dimension of pricing intelligence. Together, they form a coordinated decision engine that is transparent, data-driven, and deeply context-aware.

1. Historical Analysis

Powered by the Database Agent, this pillar analyzes the full historical footprint of the product, including average costs, margins, demand patterns, and long-term behavior. Because the Database Agent is fully integrated into the customer’s ERP or database, it works with real-time information, with no exports, no spreadsheets, and no manual effort required.

This enables a level of accuracy and granularity that traditional pricing workflows simply cannot achieve.

2. Demand Pressure

This pillar is powered by MetaLearner’s cutting-edge Forecast Agent, a forecasting engine engineered to reach an accuracy level that stands out in the industry. Unlike traditional statistical models or generic ML approaches, MetaLearner’s Forecast Agent combines machine learning, context-aware time series modeling, and automated feature detection to produce highly precise demand projections.

It consistently identifies rising trends, weakening cycles, seasonality patterns, and unexpected shifts in demand. By comparing upcoming demand with historical behavior, it adjusts pricing recommendations intelligently, strengthening prices when demand is projected to increase and considering more competitive strategies when demand is expected to soften.

This predictive precision gives companies a forward-looking advantage that significantly elevates the quality of every pricing decision.

3. Inventory Pressure

Again powered by the Database Agent, this pillar evaluates inventory levels in real time and compares them against inventory policies and thresholds. When stock is high, it encourages competitive pricing to accelerate sell-through. When stock is tight, it protects margin and prevents stockouts.

The speed and automation of this pillar allow companies to react instantly to inventory fluctuations rather than weeks later.

4. Raw Material & External Data Tracking

The External Data Agent fuels this pillar by continuously integrating external signals such as commodity fluctuations, supplier cost shifts, macroeconomic factors, and any other connected external datasets.

This provides a real competitive edge: pricing decisions reflect not just internal dynamics, but real-world market forces that affect cost and demand.

5. Safety Restriction

This final pillar is governed by the Dynamic Pricing Algorithm, which acts as a safeguard. It ensures all pricing decisions respect margin requirements, avoid risky extremes, and remain consistent with historical boundaries.

It provides the confidence and stability companies need when automating pricing at scale.

The Final Recommendation: Transparent, Editable, and in the User’s Hands

After applying the five pillars, MetaLearner generates an ideal price for each product. The platform presents the results with full explanations and gives the user the ability to accept, edit, or reject each recommendation.

Nothing is hidden. Nothing is forced. Everything is explained, and everything is powered by real-time automated data.

A Tool Designed for Simplicity, Accuracy, and Speed

MetaLearner’s Dynamic Pricing module is built to make decision-making easier, not more complicated. Instead of relying on scattered data, manual calculations, or guesswork, the platform gives users a simple, intuitive, and fully transparent way to understand product behavior and select the right price.

The goal is to empower users with clarity so they can make informed decisions quickly and with confidence. Every step, from automated data extraction to elasticity insights and optimal price recommendations, is built to balance simplicity, accuracy, and speed.

The result is a pricing process that feels natural, guided, and efficient. Users stay in control, and MetaLearner provides the intelligence they need to make better decisions in a fraction of the time.